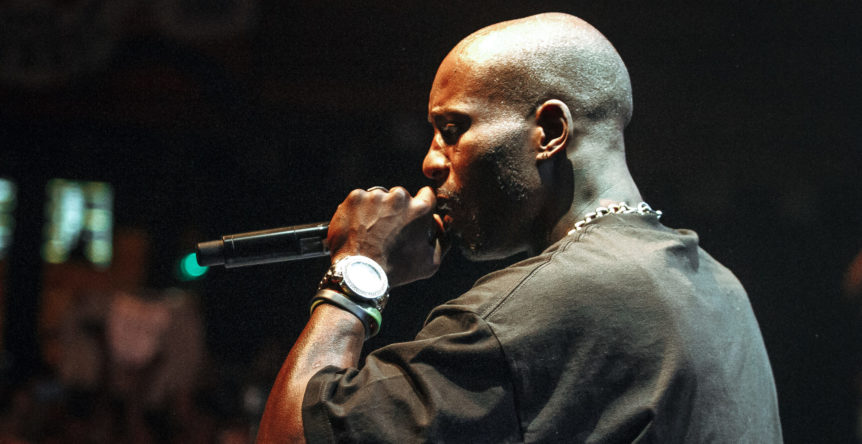

Another estate battle is in the news, and this time it takes place in our home state of New York. As reported by Page Six, several heirs of Earl Simmons, better known as DMX, are jockeying to become the administrator of the estate of the late rapper, canophile, and performer of such hits as “Get at Me Dog,” “Dogs for Life” and “For My Dogs.”

Mr. Simmons died a resident of Westchester County, survived by 14 recognized children and a fiancée. He apparently left no will.

Within a month of his death, every eligible heir or potential heir had lawyered up and rushed to the Westchester Surrogate’s Court in White Plains for an inside track to becoming the estate’s administrator. Keep in mind that the recognized children of Mr. Simmons are virtually guaranteed a share of the estate, and this fight is only for the right to manage the estate.

That seems like a lot of work for what will ultimately be an equal distribution. Why are they fighting? We discuss below.

What is an administrator?

When someone dies without a will in New York, the Surrogate’s Court must appoint a fiduciary of the estate, called an “administrator,” before any assets can be distributed to heirs. The administrator can act on behalf of the estate in all respects, unless specifically limited by the court.

Who can be an administrator?

The short answer is that, in New York, anyone can act as an administrator of any estate if they qualify, given proper waivers and consents by the priority heirs.

New York Surrogate’s Court Procedure Act (“SCPA”) section 707 sets forth certain “civil disabilities” that disqualify someone from acting as an administrator:

- persons under the age of 18;

- incompetents;

- “non-domiciliary aliens” (i.e., persons who are not U.S. citizens and who are not residents of the State of New York);

- felons; and

- persons deemed unfit under a catch-all provision (“one who does not possess the qualifications required of a fiduciary by reason of substance abuse, dishonesty, improvidence, want of understanding, or who is otherwise unfit for the execution of the office.”)

(While there is no way for a minor or incompetent to serve as an administrator, the latter three disabilities can be overcome or remediated with proper planning by a qualified probate attorney).

This brings us to Mr. Simmons’ fiancée, Desiree Lindstrom, who purportedly qualifies, but has virtually no chance of becoming administrator.

Ms. Lindstrom petitioned the Supreme Court of the State to recognize her as Mr. Simmons’ common-law spouse. As expected, the Court rejected her application, as New York hasn’t recognized common-law marriages for nearly a century.

This was likely fatal to Ms. Lindstrom’s chances of having any say in the estate because of SCPA 1001, which proscribes priority for receiving letters of administration. As one would expect, a surviving spouse has top priority, followed by children of the decedent. Thus, Ms. Lindstrom’s failure to earn recognition as a spouse puts her last in line to act as administrator, behind Mr. Simmons’ 14 children and all his other surviving relatives.

The only way that Ms. Lindstrom could possibly serve as administrator is if the priority heirs waive their rights and consent to, or designate, Ms. Lindstrom as fiduciary. Obviously, that is not likely to happen given the fierce fighting that has already occurred.

Why be an administrator?

Although it’s been reported that Mr. Simmons died with more debt than assets, the heirs are presumably fighting over the right to control an estate that will receive income from a posthumous album, lucrative royalties, and valuable licensing opportunities. So, if you’re one of Mr. Simmons’ 14 children, why not sit back and collect checks while someone else does all the work?

There are many reasons why it’s advantageous for an heir to act as administrator, particularly in an estate this valuable and with this many heirs.

The most obvious reason is that administrators are entitled to commissions for their services, as well as any distributive shares to which the administrator might be entitled. Commissions are calculated as a percentage of the estate’s gross income and assets, and they come “off the top”- before all other heirs are compensated. In an estate with high earning potential, administrators could be looking at annual commissions equal to an average American’s full-time salary… and that’s before they claim their share! Additionally, an administrator is also allowed to expense some of their costs to the estate, including legal fees.

Another enticing reason is that an administrator receives inside information about the finances of the estate that are normally unavailable to other heirs. Moreover, the administrator gets to make business and financial decisions for the estate, to the exclusion of others.

Mr. Simmons’ case also poses a unique benefit to the administrator in that he or she will be in a position to review, and potentially reject, the claims of competing heirs. More importantly, the administrator will be able to protect his interest using the funds of the estate, instead of his own. Indeed, we would expect that many more legitimate and illegitimate claimants will come forward in this highly publicized proceeding.

How will this play out?

It’s possible that one or more of the current petitioners are disqualified by aggressive competing heirs under the catch-all provision of SCPA 707. After all, the statute allows for some measure of subjectivity in assessing one’s fitness to act as fiduciary.

It’s also possible that multiple petitioners qualify, and the court simply “splits the baby” by appointing multiple co-administrators for the estate. As you can imagine, this sometimes leads to infighting, mismanagement and wastefulness when heirs cannot agree.

Finally, it’s possible that the judge just appoints a Public Administrator, or some other neutral fiduciary, who will be entitled to commissions from the estate as sort of a “tax” on the heirs for not getting along.

Either way, it seems like the heirs are in for a Ruff Ryde. Stay tuned.

Disclaimer:

The information on this website is not legal advice. It is for information purposes only. No user of this site should act or refrain on the basis of this information without seeking legal counsel. This website does not create an attorney-client relationship. Photo credit: Shutterstock Photo ID: 280465949